The PEO Alternative

When it comes to outsourcing Human Resources and payroll, small to medium size businesses have a couple of different options. If a business chooses to work with a third party to manage these aspects of their company, they will generally choose to work with a Professional Employer Organization (PEO) or a Shared Service Organization like HRBOOST®. Many businesses choose to work with a PEO, and while a PEO can benefit small to medium size businesses, there are still some risks and disadvantages to working with such an organization. At HRBOOST®, we offer a Shared Service model that has more advantages than a PEO as we will work with your company to integrate and share the responsibility of your HR strategy.

What is a Shared Service Organization?

HRBOOST® is a Shared Service organization and we serve our clients by providing a dedicated HR Team with diverse, yet focused, capability in Human Resources instead of one person with potentially limited experience. The key to Shared Services is to understand the level of integration in support for shared accountability of results established by the client from where the work is migrated to the provider. In other words, we will understand your goals when it comes to your HR strategy and share the implementation and results of the strategy. We will ensure that the agreed results are delivered based on defined measures and at a pace and budget that works for the client.

What is a PEO?

A Professional Employer Organization (PEO) is an organization in which small to medium size businesses can outsource their administrative needs in order to be more productive. PEOs generally take care of HR, payroll, benefits, ACA compliance, health insurance, tax administration, and other ancillary services. Think of a PEO as a company in itself focused specifically on the operations that you outsource to them.

What are the Risks and Disadvantages of Working with a PEO?

HR, Payroll, and Tax Administration are entirely in the hands of the PEO.

To some companies this may be a benefit. Outsourcing these tasks completely can free up businesses to devote more of their time and resources to the business itself which can help small to medium sized businesses grow. However, you are relinquishing control of these tasks entirely to the PEO which may not be the best option. PEOs “co-employ” your employees and are considered the “employer of record for tax purposes” since they will file the tax documents for your employees. If the PEO does not properly file the taxes on your company’s behalf, it is your company that will be assessed the penalties.

The other possible issue with the co-employment model is that implementing the HR strategy is not a collaborative effort. PEOs generally handle the implementation of the PR strategy themselves and the PEO professional assigned to your company’s account will likely work remotely. At HRBOOST®, we will work with you to collaborate on your HR strategy and share the responsibility. We also dedicate a team of professionals to your account who are present and will even work on-site at your office.

PEO pricing plans are not transparent.

PEOs will charge your company a percentage of your payroll, but the exact charges can be difficult to decipher. They will generally lump together the charges for all of their services including HR, payroll, taxes, and their admin fee. PEOs will also lock you into long-term, multi-year contracts and change their rates with little warning. At HRBOOST®, we will provide more flexible agreements for 30 to 60-day contracts and we will charge a flat rate per hour, month, or project. That way you will know exactly what you are paying with no surprises or long-term commitments.

PEOs offer limited health plan choices.

Many small to medium size business use a PEO because they can offer discount rates on health insurance, making it less expensive for businesses to cover their employees. However, PEOs generally only offer health insurance plans from one or two different carriers that have partnered with them. If you or your employees are not happy with the health plans offered by these specific carriers, you are stuck with them.

PEOs use antiquated systems.

PEOs often do not use the latest technology to keep track of your account and create reports. It can sometimes take extra time for a PEO to create a custom report. You should be able to trust the company in charge of your payroll, benefits, and health insurance to use the latest technology to protect sensitive data.

Customer service from PEOs is lacking.

The customer service from PEOs is usually lacking as they work remotely from your business and tend to answer questions and concerns through email. Sometimes a question will get passed between several different employees before the PEO gets back to you. This can make dealing with their customer service impersonal and time consuming.

At HRBOOST®, we dedicate a team of employees to your account who are ready to answer your questions or concerns. We will even work on-site at your business so you can discuss matters with our team face to face. Because we are sharing the responsibility of your HR strategy with your company, we believe it is important to build a professional, yet personal relationship with your company and to have a presence in your office.

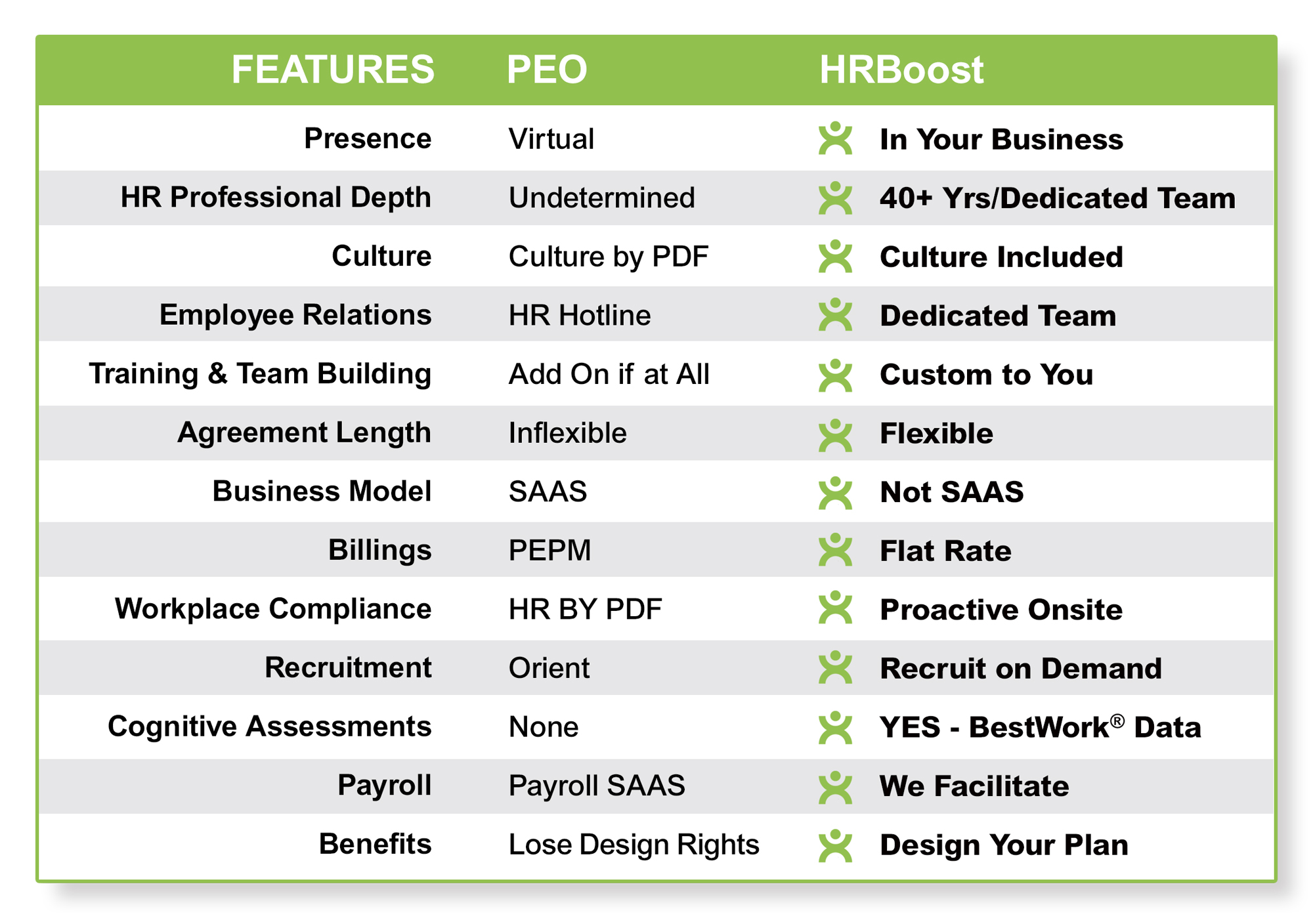

What are the Top Differences Between HRBOOST® and a PEO?

If a PEO Isn’t Right For Your Business, Talk to HRBOOST®!

Give Us A Call At (847)-736-5085

Related Information